Putting the interest in interest rates

With inflation running rampant and Andrew Bailey, a man so inept he pays full price for a DFS sofa, I suspect following his 0.5% increase last month Bailey will be under further pressure to combat the prediction of inflation peaking at 13.3% next year.

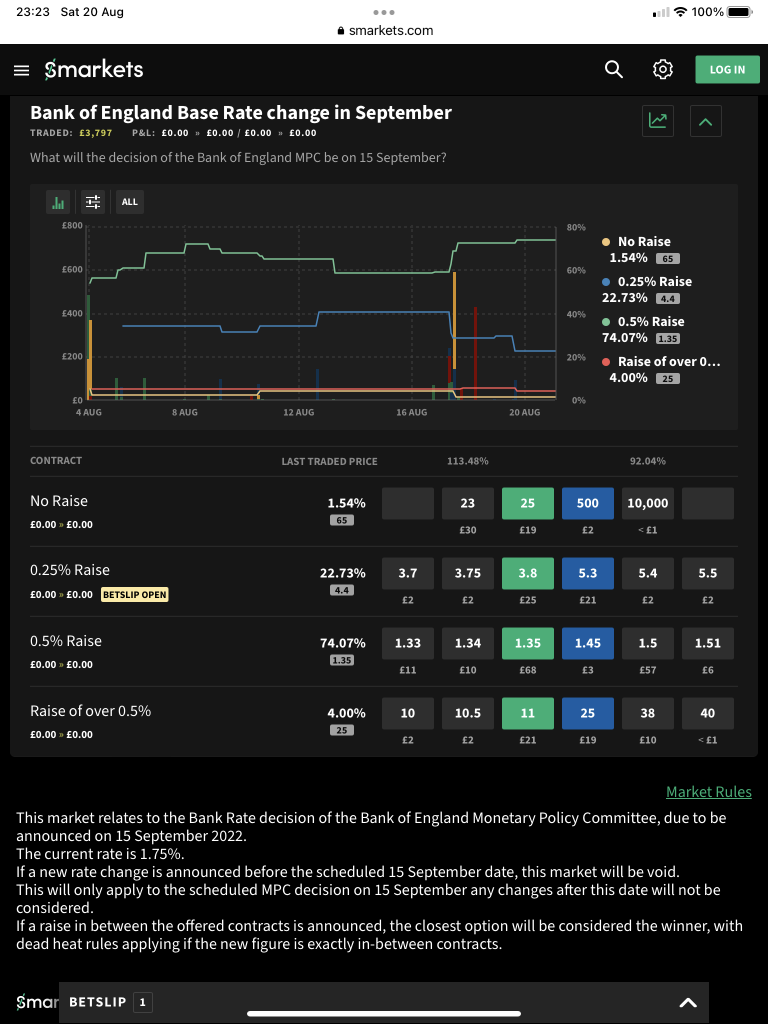

Tradition and history suggest the optimal way to combat the scourge of inflation is to increase interest rates, with Liz Truss ‘say[ing] she will change the mandate of the BoE to toughen its focus on inflation, while she claims that the Treasury‘ so I’m expecting Bailey to do something spectacular to please the incoming Prime Minister which leads to this betting market from Smarkets.

In my humble opinion Bailey might just go for a raise of above 0.5% which of course would also go down with the Tory client vote who no longer have mortgages so the 11s on a raise of over 0.5% look attractive.

Even a 1% increase would put interest rates at 2.75% which is by historic standards is very low and probably a damning indictment of the current economic situation that interest rates of 2.75% could be very bad for the economic situation of many households.

TSE